Page 3 - FI_2022 Annual Report_Digital Bi Fold_2023.04_FINAL

P. 3

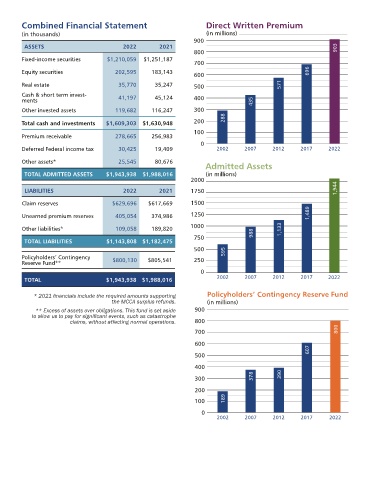

Combined Financial Statement Direct Written Premium

(in thousands) (in millions)

900

ASSETS 2022 2021 903

800

Fixed-income securities $1,210,059 $1,251,187

700

Equity securities 202,595 183,143 696

600

Real estate 35,770 35,247 500 571

Cash & short term invest- 41,197 45,124

ments 400 435

Other invested assets 119,682 116,247 300

Total cash and investments $1,609,303 $1,630,948 200 288

100

Premium receivable 278,665 256,983

0

Deferred Federal income tax 30,425 19,409 2002 2007 2012 2017 2022

Other assets* 25,545 80,676

Admitted Assets

TOTAL ADMITTED ASSETS $1,943,938 $1,988,016 (in millions)

2000

1,944

LIABILITIES 2022 2021 1750

Claim reserves $629,696 $617,669 1500

Unearned premium reserves 405,054 374,986 1250 1,489

1000

Other liabilities* 109,058 189,820 1,133

750 988

TOTAL LIABILITIES $1,143,808 $1,182,475

500 595

Policyholders’ Contingency $800,130 $805,541 250

Reserve Fund**

0

TOTAL $1,943,938 $1,988,016 2002 2007 2012 2017 2022

* 2021 financials include the required amounts supporting Policyholders’ Contingency Reserve Fund

the MCCA surplus refunds. (in millions)

** Excess of assets over obligations. This fund is set aside 900

to allow us to pay for significant events, such as catastrophe

claims, without affecting normal operations. 800

700 800

600

607

500

400

300 378 390

200

100 189

0

2002 2007 2012 2017 2022